do you pay taxes when you sell a car in illinois

It starts at 390 for a one-year old vehicle. You typically have to pay taxes on a car received as a gift in Illinois.

Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales.

. The car was an. You will need Form RUT-50 to report the gift. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

It ends with 25 for vehicles at least 11 years old. Thankfully the solution to this dilemma is pretty simple. Heres a vehicle use tax chart.

Although a car is considered a capital asset when you originally purchase it both state and federal governments consider selling your car for more than you invested as a profit. Once the buyer has the vehicle registered under his name he must pay to sell Texas. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

You should attach a copy of the bill of sale as proof of the purchase price. There also may be a documentary fee. In addition to completing the application form you will also need to pay the transfer fee of 25.

You may qualify for a tax exemption if. The short answer is maybe. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. Do you have to pay taxes on a car thats a gift in Illinois. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

The tax rate is based on the purchase price or fair market value of the car. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

If you are transferring your license plates and titling the car at the same time there is an additional 155 fee. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

The supplier reseller who makes the courtesy delivery is not responsible for the declaration of the sale. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference. Then the difference is.

The buyer will have to pay the sales tax when they get the car registered under their name. Instead the buyer is responsible for paying any sale taxes. Who pays sales tax when selling a car privately in Illinois.

REPLACEMENT VEHICLE TAX If you are a selling dealer in Illinois and the buyers address is in Illinois for title and registration purposes you are responsible for filing the ST-556 tax return and paying the sales tax due. Thats 2025 per 1000. When you choose to lease a car in Illinois youll pay sales tax on the cost of your new or used car the key factor is that youll only owe tax on the part of the car you lease your monthly payment rather than on the total value of the vehicle.

How much can you sell before paying tax. This system applies to all used cars that you sell. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes.

You do not need to pay sales tax when you are selling the vehicle. A list of all the states for which you must collect sales tax and the rate you must charge can be found on the Illinois Department of Revenues website at. When an Illinois resident purchases a vehicle from an out-of-state dealer and will title the car in Illinois the sale and subsequent tax due is reported on Form RUT-25 when you bring the vehicle into Illinois.

In addition to state and county tax the City of Chicago has a 125 sales tax. There is also between a 025 and 075 when it comes to county tax. For example if you purchased a used car from a family member.

However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled Capital Gains and Losses The form will instruct on you needed information. For vehicles worth less than 15000 the tax is based on the age of the vehicle. There are some circumstances where you must pay taxes on a car sale.

Volkswagen Ad Fad Vintage Volkswagen Volkswagen Beetle Vw Volkswagen

6 Steps To Limit Risk When Selling Your Car Privately Driveo

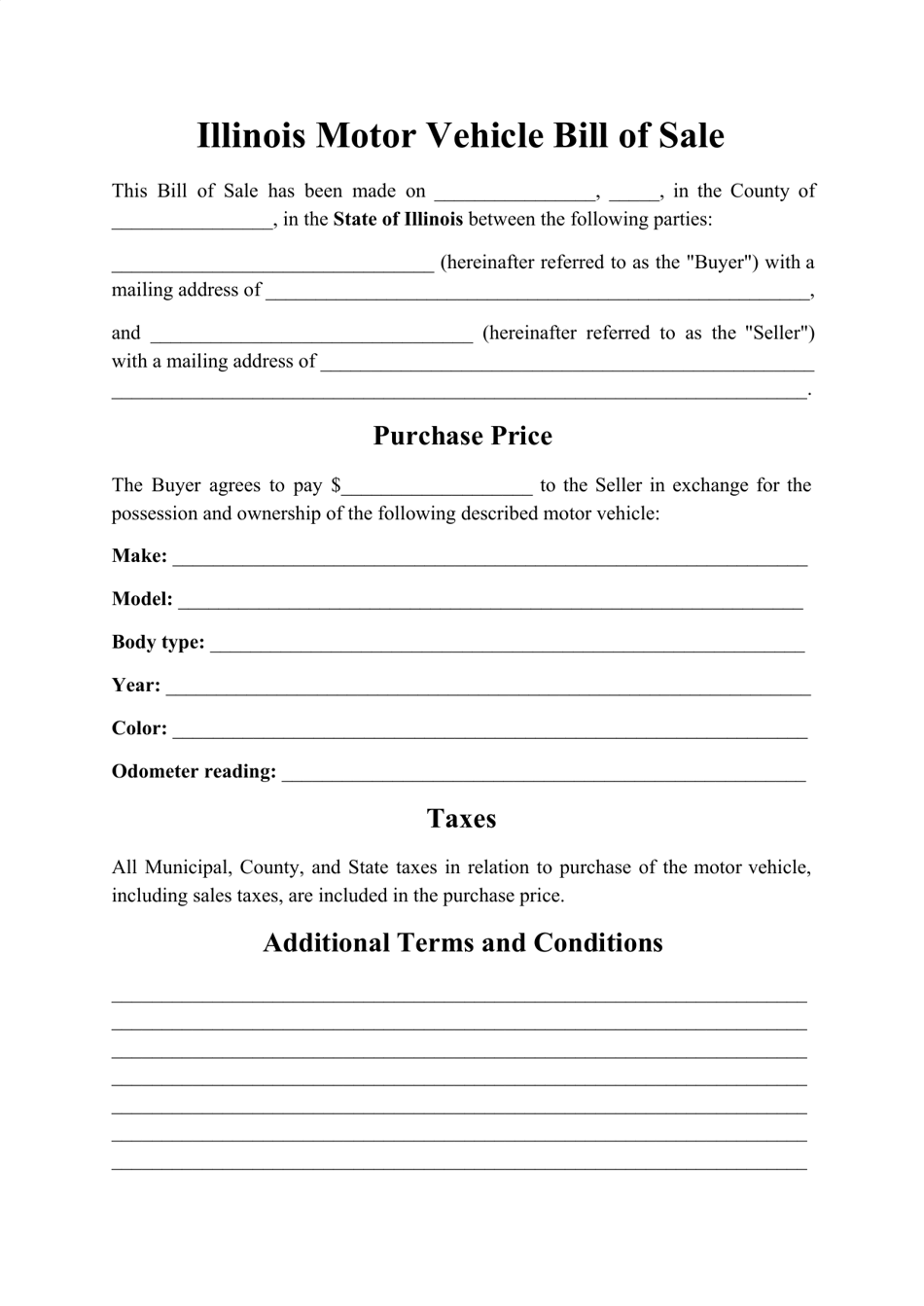

Free Illinois Bill Of Sale Forms Pdf

How Do I Sell My Car Illinois Legal Aid Online

How To Buy And Sell Cars Without A Dealers License Sane Driver

What Is The Safest Form Of Payment When Selling A Car Sell My Car In Chicago

How To Gift A Car A Step By Step Guide To Making This Big Purchase

What S The Car Sales Tax In Each State Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

Nj Car Sales Tax Everything You Need To Know

How To Safely Sell Your Car Edmunds

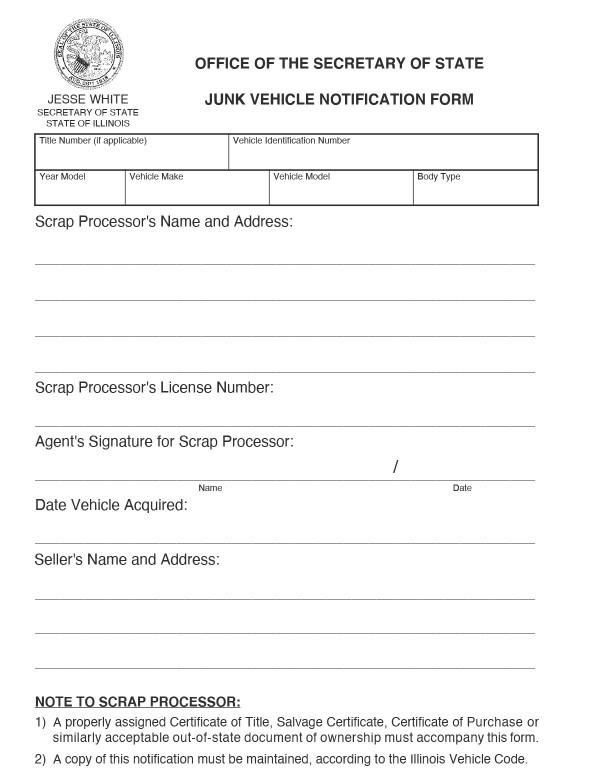

Illinois Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

How To Get A Donated Car From Goodwill Or Salvation Army

Flipping Cars For Profit Step By Step Guide Updated For 2021

How To Safely Sell Your Car Edmunds

What Happens To New Cars That Don T Sell

How To Sell A Car In Illinois Metromile

Trade In Car Or Sell It Privately The Math Might Surprise You